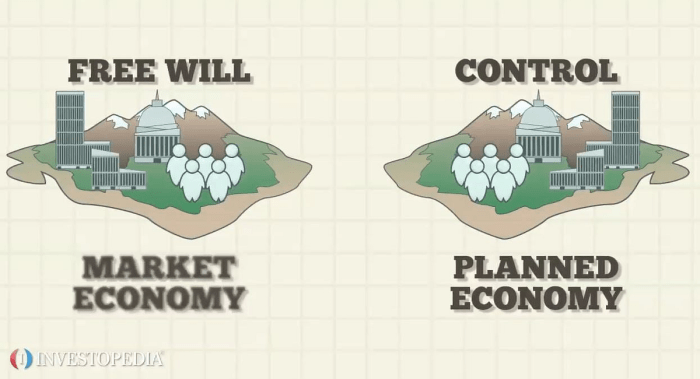

According to classical economists market driven economies – According to classical economists, market-driven economies are characterized by the free interaction of supply and demand, leading to efficient resource allocation and economic growth. This introductory paragraph provides a concise overview of the topic, capturing the essence of classical economic thought on market economies.

The second paragraph delves into the concept of market equilibrium, explaining how the interplay of supply and demand determines prices and quantities in a market. It also discusses the role of the invisible hand, highlighting how individual self-interest can contribute to socially beneficial outcomes.

Market Equilibrium

According to classical economists, market equilibrium occurs when the quantity supplied in a market equals the quantity demanded. This point represents a balance between the forces of supply and demand, where neither buyers nor sellers have an incentive to change their behavior.

The equilibrium price is determined by the interaction of supply and demand curves. When supply exceeds demand, prices fall until the excess supply is eliminated. Conversely, when demand exceeds supply, prices rise until the excess demand is eliminated.

Examples of Market Equilibrium, According to classical economists market driven economies

- In a competitive market for wheat, the equilibrium price is determined by the intersection of the supply and demand curves. Farmers will supply wheat at a certain price, and consumers will demand wheat at a certain price. The equilibrium price is the price at which the quantity supplied equals the quantity demanded.

- In the market for labor, the equilibrium wage rate is determined by the intersection of the supply and demand curves. Workers will supply labor at a certain wage rate, and employers will demand labor at a certain wage rate. The equilibrium wage rate is the wage rate at which the quantity of labor supplied equals the quantity of labor demanded.

The Invisible Hand

The theory of the invisible hand, introduced by Adam Smith, suggests that individual self-interest can lead to socially beneficial outcomes in a market economy. According to this theory, individuals pursuing their own economic self-interest are guided by an “invisible hand” to promote the general welfare of society.

For example, in a free market, businesses compete to produce goods and services that consumers want. In doing so, they not only satisfy their own profit-seeking motives but also create wealth and economic growth for the entire society.

Limitations of the Invisible Hand

While the invisible hand can lead to efficient outcomes, it also has its limitations. Market failures can occur when individual self-interest leads to negative externalities, such as pollution or market power.

In such cases, government intervention may be necessary to correct market failures and ensure the overall well-being of society.

Economic Efficiency

Economic efficiency refers to the allocation of resources in a way that maximizes the satisfaction of human wants. In a market economy, efficiency is achieved when the equilibrium price of a good or service is equal to its marginal cost of production.

Competition plays a crucial role in promoting economic efficiency. In competitive markets, businesses are forced to minimize their costs and produce goods and services that consumers value.

Sources of Market Failure

Market failures can occur when competition is restricted or when externalities exist. Externalities are costs or benefits that are not reflected in the market price of a good or service.

Examples of market failures include monopolies, pollution, and public goods. These failures can lead to inefficient outcomes and a reduction in overall economic efficiency.

Economic Growth: According To Classical Economists Market Driven Economies

Market-driven economies are characterized by innovation, investment, and economic growth. Innovation creates new products and services, which can lead to increased consumer spending and economic expansion.

Investment in capital and human resources can also contribute to economic growth. Capital investment, such as new machinery or technology, can increase productivity and output. Human capital investment, such as education and training, can improve the skills of the workforce and lead to higher levels of innovation.

Government Policies and Economic Growth

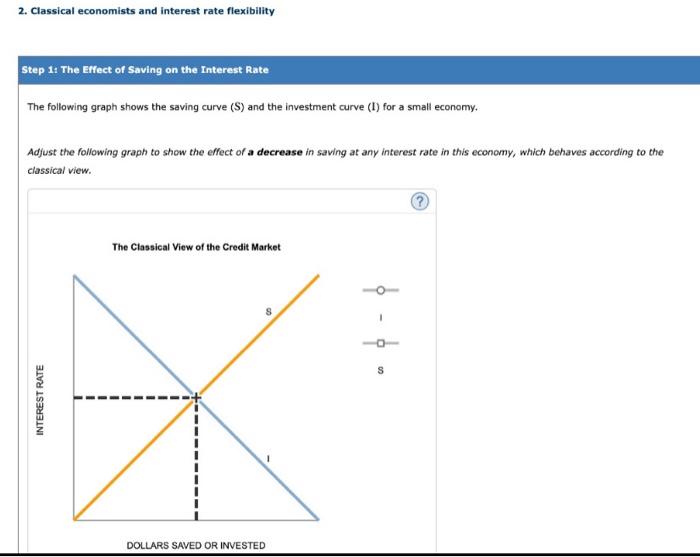

Government policies can play a significant role in promoting economic growth. Fiscal policies, such as tax cuts or government spending, can stimulate economic activity. Monetary policies, such as changes in interest rates, can influence the availability of credit and investment.

However, government policies must be carefully designed to avoid unintended consequences, such as inflation or excessive debt.

Social Equity

Social equity refers to the fair and just distribution of economic resources and opportunities. While market-driven economies can create wealth and economic growth, they can also lead to income inequality and social disparities.

Market failures, such as monopolies or externalities, can exacerbate social inequality. Additionally, the distribution of wealth and income can be influenced by factors such as education, access to healthcare, and discrimination.

Government Policies and Social Equity

Government policies can play a role in addressing social equity concerns. Progressive taxation, which places a higher tax burden on the wealthy, can help redistribute income and reduce inequality.

Government programs, such as social welfare programs or minimum wage laws, can also help to ensure that everyone has a fair chance to participate in the economic system.

FAQ

What is the key principle of classical economic thought?

The key principle is that markets are self-regulating and will naturally tend towards equilibrium, where supply equals demand.

How does the invisible hand promote economic efficiency?

The invisible hand refers to the idea that individual self-interest, when operating within a market system, can lead to socially beneficial outcomes, such as efficient resource allocation.

What are the potential limitations of market-driven economies?

Market failures can occur due to factors such as externalities, monopolies, and information asymmetries, leading to inefficiencies and social disparities.